One of the key concerns in the financial industry today is the alarming increase in fraudulent activities. It is estimated that over $12 billion is spent on fraud detection and prevention and that number is projected to increase significantly over the next few years. Customer data gets compromised and this leads to a decreased level of customer satisfaction and retention, which results in revenue declines for financial organizations.

Join Hortonworks, Skytree and Forrester Research for a Webinar on April 15, 8am PST/11am EST

As financial institutions continue to embrace the adoption of big data infrastructures like the Hortonworks Data Platform based on Hadoop, there is a wealth of information collected that can help with more sophisticated fraud detection. The key challenge is accessing this information and turning it into meaningful insights for pattern recognition that can lead to better fraud prevention.

Hortonworks, Skytree and Forrester have partnered in an upcoming webinar to help financial organizations better understand the challenges with fraud and how to minimize fraud through the use of big data analytics and tools. The webinar, “The next frontier in fraud management: Big Data,” each of these companies will offer key insights into new fraud mechanisms, trends in fraud detection and how Hadoop can be used for fraud prevention. Join us on April 15 at 11 am Eastern time, 8am Pacific time.

Forrester Research, a global research and advisory firm with a focus on big data, states that financial institutions using big data must assume big responsibility for that data in order to prevent fraud. Forrester Research has done extensive research on the types of fraud and fraud management trends, and will discuss what financial organizations need to look for in their big data deployments to minimize fraud.

Hortonworks will offer our extensive experience on Hadoop and how HDP is being used to mitigate risk with our financial services customers. Recent use cases include screening new account applications that are at risk of default, providing surveillance of trading logs for anti-laundering, and maintaining sub-second SLAs for ticker plants. Read more about Hortonworks and financial services and view the reference architecture.

Skytree®, the Machine Learning Company, offers a wide variety of analytic tools and algorithms to extract high quality insights from Hadoop quickly. Because Skytree’s solution runs at machine scale, it is an ideal solution for financial organizations as they look to detect fraud earlier in the fraud prevention cycle.

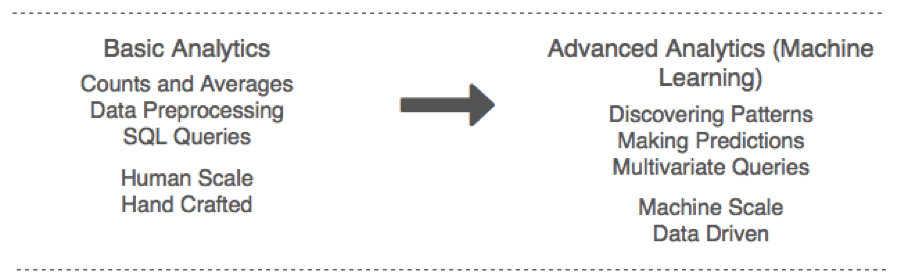

Machine learning extracts value from big (and disparate) data sources and is not limited to human scale thinking and analysis. It discovers the patterns buried in the data at machine scale, and it is data driven: unlike for traditional analysis, the more data fed to a machine learning system, the more it can learn, resulting in higher quality insights.

Skytree Server® also supports a wide variety of analytic tools and algorithms that help organizations get the most out of their data and derive high quality insights:

- Value Prediction: predicts the future outcome or value of products and services

- Outlier Detection: detection of outlier events

- What if analytics: analyzes large data sets and can be used to answer questions on enterprise job scheduling, logistics, supply chain management

Skytree Server is a Hortonworks certified technology partner, certified on HDP 2 so you can be confident these solutions have been tested and work together on the latest Hortonworks platform.

Register now for this webinar on how to mitigate risks and minimize fraud in your financial organization.

For more information on Skytree, visit http://hortonworks.com/partner/skytree and http://skytree.net

The post Webinar: Fighting Fraud in Financial Services with Hadoop appeared first on Hortonworks.